Why I'm moving back to Hargreaves Lansdown from AJ Bell

Why I'm moving from AJBell back to Hargreaves Lansdown

Update 23/02/2022: The way you login to Aj Bell is changing - see https://www.youinvest.co.uk/login-update from what I can tell there is no more of this "enter three characters from your password" nonsense. I'll update this article when the new login is released to all. My login is currently the old process as outlined below.

As a technologist who likes to control my own future, I've managed my own investments for years in an ISA and SIPP. I was very happy with Hargreaves Lansdown but the annual investment report always showed that I was paying quite a lot in fees.

My investments were amix of shares, funds, ETFs and a few Investment Trusts. I worked out that AJ Bell was going to be cheaper over the year, andf of course these things compound over time, so over a couple of decades I'd be thousands better off. Or will I?

Since moving to AJ Bell in May 2019, I've found that I'm dealing much much less than I used to on the HL App because the AJ Bell app is so unfriendly. As a result, during the latest Covid-19 crash, I've been missing out on shares I wanted to buy. This is down to my laziness too be honest, but the AJ Bell app just makes life difficult. I'll show you why.

I use a password manager called 1Password. For the less tech savvy, using the same password across multiple accounts is bad. It can lead to what's called Credential Stuffing which is where a leaked password from one website is tried on many other websites.If someone uses the same password across accounts then they will gain access to other sites leading to account hijack. 1Password allows me to have long, umique passwords across all my accounts, as well as managing two factor authentication which Aj bell does support. A password that is easy to remember is generally a terrible password to use!

The NCSA (National Cyber Security Centre) says;

Yes. Password managers are a good thing.

Unfortunatley, using a long, unique random password makes it very hard to use AJ Bell on a mobile device and to a lesser degree on their website.

Reason to leave #1 - authentication to deal

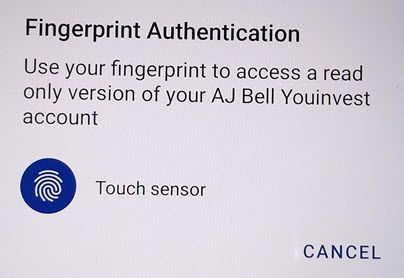

It's good that you can setup fingerprintg login for AJ Bell. It's fast and effcient. Note that the screen says "access a read only version" of your account.

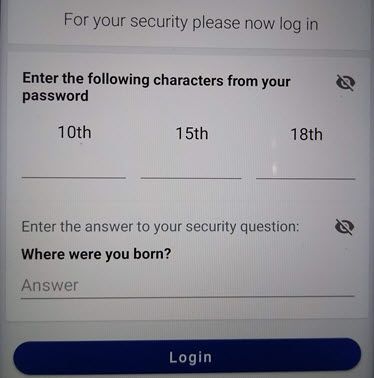

but when you want to actually trade, you need to enter some characters from your password (rember - this is long, unique and random)!!!!

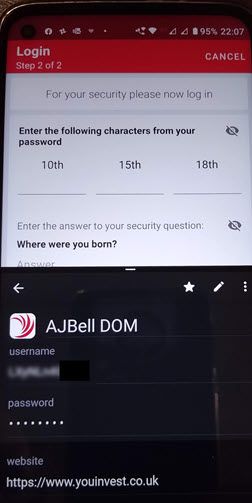

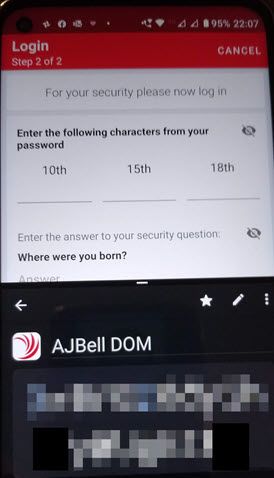

To avoid writing down a password on some paper, or using a useless password such as P@ssw0rd1 or worse 123456 (or one of the other useless top 10 hacked passwords ) I need to be able to "split screen" with 1Password to use them both at the same time (this is available on later versions of Android).

Then I need to be able to see the password so I can literally count the characters for entry into the screen. I achieve this by using the Large Type option in 1Password. You can see this in the blurred bit in the image below. This allows me to see the password in large text so I can count the characters and enter them into the AJbell app.

Believe it or not, it's the same process on the website too. It's a little easier because the large type feature of 1password is in a draggable window you can hover over the password entry boxes making it slightly easier than the mobile app.

Authenticating to deal is difficult! If I used a simple password I could do it ok, but I wont comporomise on using strong passwords. I've been pwned too many times!

Reason to leave #2 - Searching

During the Covid-19 crash, there were some shares that were massively hit such as airlines, hospitality and rwelated industries. I wanted to buy Rolls Royce the aero engine maker. They had dropped around 60% from peak which I thought was a bit of an over-reaction and worth a long term punt.

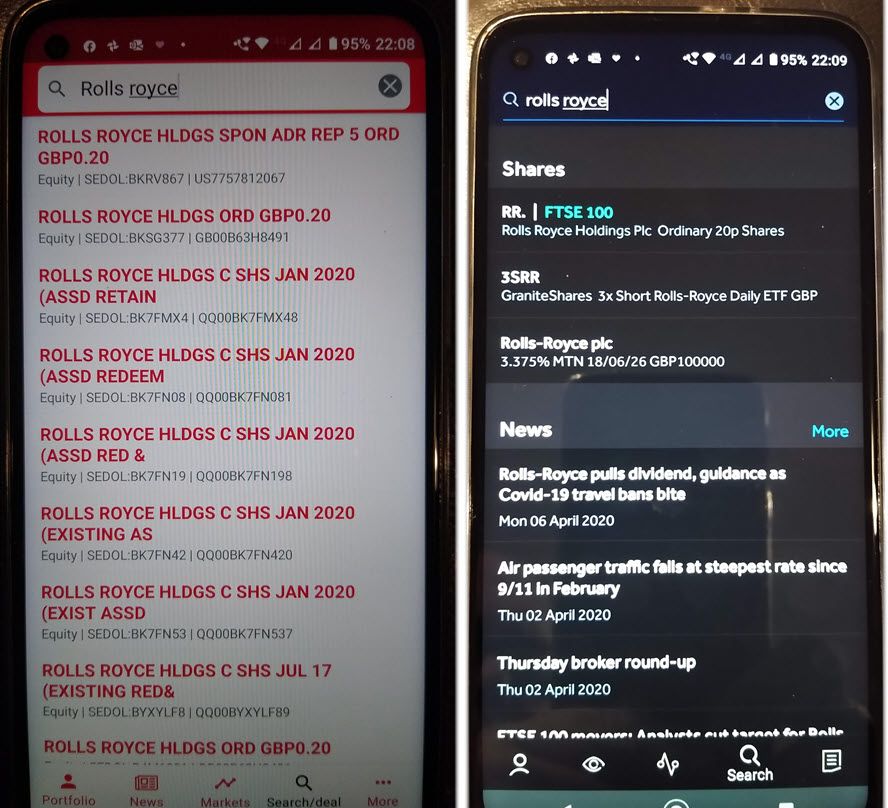

So what happens if you search for "Rolls Royce" in Aj Bell (left screen) and the same search in Hargreaves Lansdown (right screen)? Which one is the FTSE100 share I want to buy?

Conclusions

The two gripes above may seem trivial to many users (possibly those that use "password1" as their password) but I fail to underdstand why these descisions have been made. Do they think that it makes the app more secure even when logged in via finger print? How come Hargreaves Lansdown is only showing two possible Rolls Royce options (the third is a Rolls Royce short) whereas Aj Bell is showing me nine choices? Two of these are "Rolls Royce Hldgs Ord GBP0.20", one of which I suspect is the share I want to buy, but I'd need to click into the result to check, then go out and check the other one to be sure.

I've since started to invest far more in Investment Trusts and less in funds (which are slow to sell and don't seem to offer much advantage). Hargreaves don't charge to hold Investment Trusts, I suppose because they're just shares at the end of the day. There's still a platform fee, but holding little or no funds has massively reduced my annual fees. Using Hargreaves the dealing process is far simpler, so I would've been buying and selling far more often than I have been with AJBell.

As I've found, a few more pence makes a lot more sense. Hargreaves Lansdown may well still be a little dearer than AJBell, but I would've made back the difference and more by buying and selling more frequently (possibly).

keywords ajbell a j bell versus v hargreaves hl compare comparision app mobile iphone android online youinvest isa sipp invest investments funds fund trust fees